What does stepped cost mean?

True valuable costs are those variable costs that have a direct and one to one relationship with output levels of a business. In other words, these costs are directly proportionate to output and change with every change in output level. So, if for every single unit increase in output, a particular cost element also increases by a specific quantum then this cost would qualify as a true variable cost. This example showcases how a slight change in the activity level (number of guests) can lead to a substantial jump in costs due to the step nature of the variable costs.

Accounting Dictionary

- Overtime shifts can help you produce more units without hiring additional full-time staff.

- In many cases, businesses have a need to further refine their overhead costs and will track indirect labor and indirect materials.

- For this reason, the production supervisors’ salary would be classified as indirect labor.

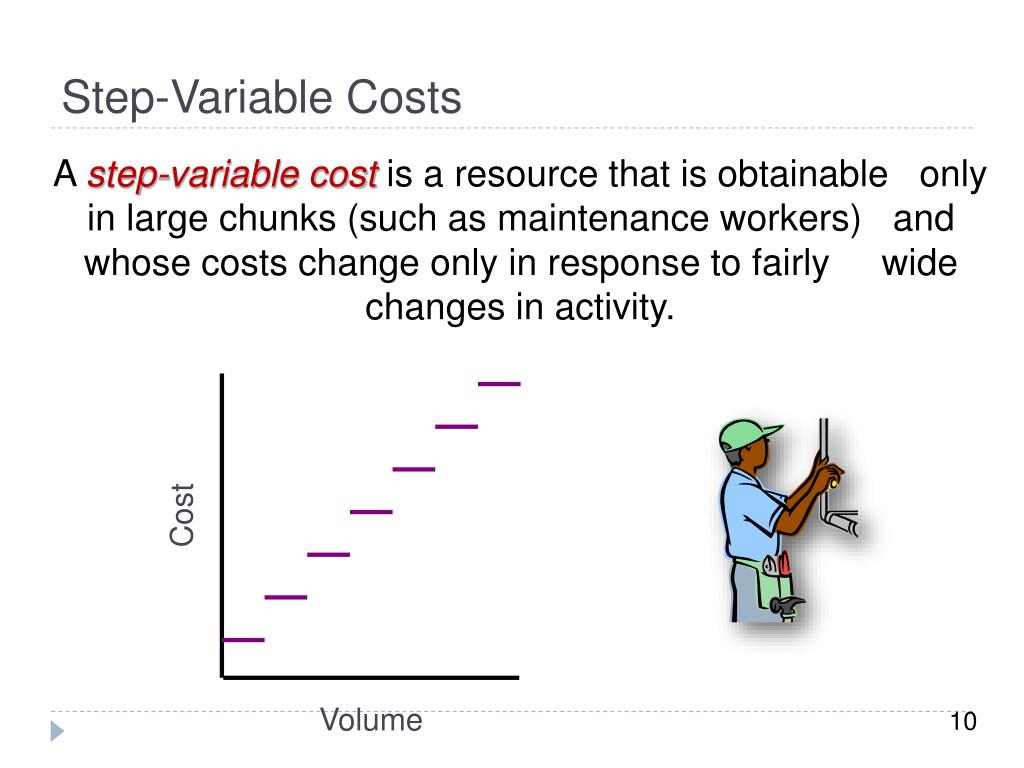

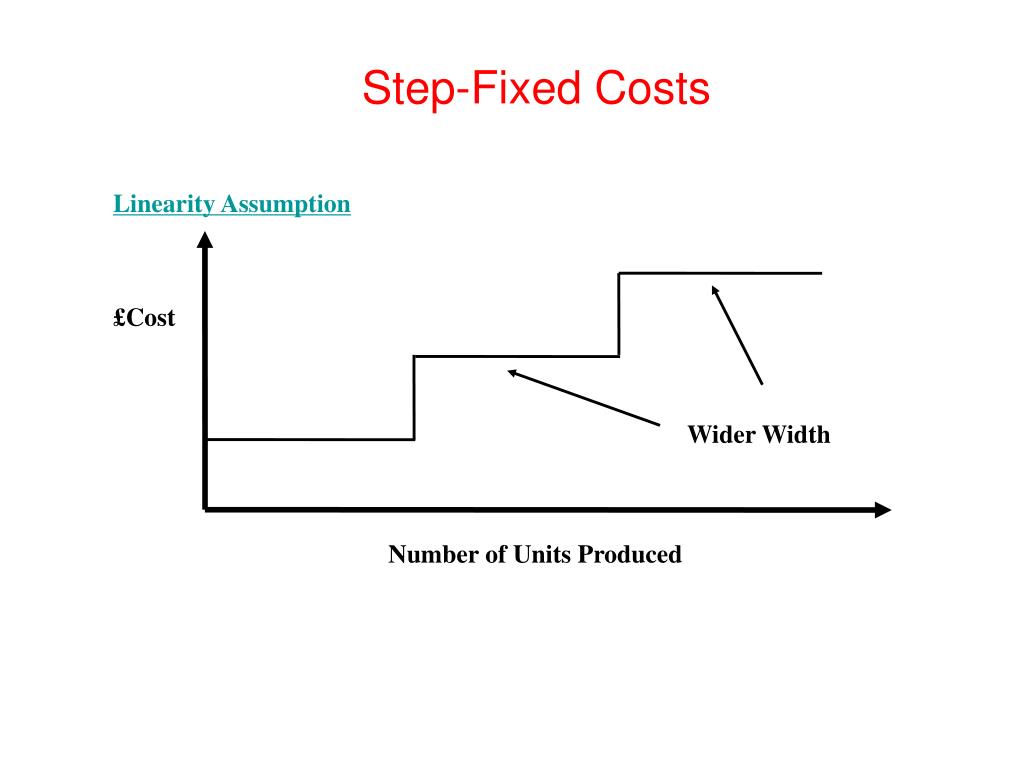

For instance, wages often act as a stepped variable cost when employees are paid a flat salary and a commission or when the company pays overtime. Further, when additional machinery or equipment is placed into service, businesses will see their fixed costs stepped up. Step costs are costs that remain constant over a range of activity levels but increase to a new level once a certain threshold is crossed. This behavior makes step costs distinct from fixed and variable costs, as they do not change with every unit produced, but instead jump in increments. Understanding step costs is crucial for analyzing cost behavior patterns and creating flexible budgets, as they can significantly impact financial planning and decision-making. When labor costs are incurred but are not directly involved in the active conversion of materials into finished products, they are classified as indirect labor costs.

What does stepped cost mean?

As these costs vary directly in proportion to the level of production, they would not be incurred in situations where production level is zero. Many prisons and jails analyze step costs based on annual prisoner cohort numbers. If cohorts are fewer, step costs fall because there are fewer people to feed, clothe, and monitor. This also leads to decreased demand for staff for those types of labor.

Examples

For example, a local high-tech company did notlay off employees during a recent decrease in business volumebecause the management did not want to hire and train new peoplewhen business picked up again. Now that we have identified the three key types of businesses, let’s identify cost behaviors and apply them to the business environment. In managerial accounting, different companies use the term cost in different ways depending on how they will use the cost information. Different decisions require different costs classified in different ways. For instance, a manager may need cost information to plan for the coming year or to make decisions about expanding or discontinuing a product or service.

These costs also vary with the level of output but they have a staggered relation with the level of output. Conversely, a company should be aware of step costs when its activity level declines, so that it can reduce costs in an appropriate manner to maintain profitability. This may what is the accounting equation, and how do you calculate it require an examination of the costs of terminating staff, selling off equipment, or tearing down structures. After doing market research, John is certain that he’d have demand for at least 1,050 units. This would require buying a second machine, incurring a step cost of $5,000.

However, once that level is breached, step cost graph increases or decreases in a step-like fashion. A variable cost that is paid becomes a form of fixed cost called a sunk cost. Avoidable fixed costs become unavoidable fixed costs once the cost has been paid. Likewise, a variable cost becomes a sunk cost once it has been paid as shown in the figure below.

Step costing is extremely important to be aware of when a company is about to reach a new and higher activity level where it must incur a large incremental step cost. In some cases, incurring the extra amount of a step cost may eliminate profits that management had been expecting with an increase in volume. Step costs move up and down in a step-like manner—horizontally over a range, then vertically, then horizontally, and so on. The opposite is true, too—if business activity slackens, a material portion of costs will drop, with a step-down. To return to the example, this means that the QA person could be more efficient or work somewhat longer hours in order to avoid incurring the large incremental cost of an additional person. In such a situation, it may be more cost-effective for the employer to offer overtime to the existing staff than to pay the more substantial cost of a new hire.

When the visits are in the range of 1,000 to 2,999 the monthly cost jumps to $50. As the data indicates, the total monthly cost is constant or fixed only for a given range of activity (number of visits). When the number of visits exceeds the upper limit of a range, the monthly cost jumps to a higher level and remains fixed until the visits exceed the new upper limit. Stepped cost refers to the behavior of the total cost of an activity at various levels of the activity. For example, if a company’s sales were not doing well, management may sell off an entire production line. The step cost for several expenses would abruptly decrease since all expenses related to that production line would be cut.