QuickBooks: How to Fix Opening Balance Equity Issues

I now have as you did in the video a balance of zero when I go to reconcile. In trial balance this scenario, the funds from the OBE account should be allocated based on the nature of the adjustments. At this point, the balance might come from several sources, including adjustments and accruals. OBD is only added to once, on that beginning date, or if you forgot about an asset but you still use the same initial date.

- Not closing out this account makes your balance sheet look unprofessional and can also indicate an incorrect journal entry in your books.

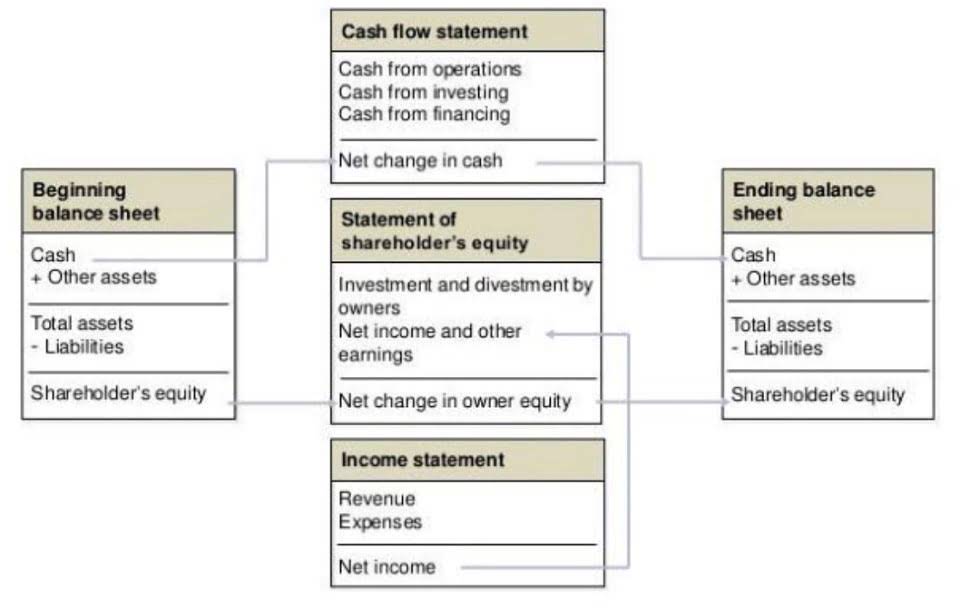

- Using accounting software can help you figure out what is missing, or you can fill out an accounting template and see the numbers in front of you.

- Let us know in the comments if you require further assistance managing your accounts or any other concerns in QBO.

- The best practice is to close opening balance equity accounts off to retained earnings or owner’s equity accounts.

- To do so, you might want to create a journal entry to transfer the balance of the OBE account to the appropriate equity accounts.

- Look into the Intuit Find-A-ProAdvisor site to find certified professionals in your local area that are sure to have the answers you’re looking for.

- The corrective action would involve a journal entry to debit opening balance equity for $20k, credit owner contributions for $10k, credit retained earnings for $2,500, and credit debt for $7,500.

Common mistakes to Avoid

- This is a good indicator as opening balance equity account should be temporary by design.

- @lynda and Matthew @ParkwayInc here to give you a live discussion on what an equity account is and it’s meaning to the business owner as well as its relationship to the other balance sheet accounts.

- For example, outstanding balances may result in an accounts receivable opening balance.

- I also recommend getting in touch with an accounting professional for a personalized opinion.

- Retained earnings refer to the profits earned by a company, minus the dividends it paid to the shareholders.

- When you create a new inventory item (see image below), you’ll see a field asking for the initial quantity on hand.

If you want to correct the amount or date, and or delete an opening balance, just do so from the register. Please touch base with us if you any concerns about transferring your data to QBO. All this frees you up to spend your time on what really matters, your business! Get in touch today for a no-obligation, free demo to find out what Mooncard can do for you.

- If you have a balance in this account, you need to work with your accountant to reallocate the balances to their proper accounts in the ledger.

- A very simple example can illustrate how the opening balance of a company is calculated.

- Simply record the initial deposit as a deposit since it’s a money-in transaction.

- If the company has outstanding vendor or customer balances, these should be entered as of the start date of the new company file.

Everything to Run Your Business

For example, if you’re transferring a business savings account to a personal account, zero out the balance in the business savings by recording a distribution to yourself before making the account inactive. Adding a new inventory unit with the initial quantity on hand will also affect Opening Balance Equity. Recording an initial inventory quantity is essentially the same as recording an opening balance in the inventory account and creates the problem discussed in the two earlier sections. There should opening balance equity be zero are several reasons why you have an Opening Balance Equity account. However, that doesn’t immediately mean you committed a mistake in using QuickBooks—it’s just how the system works. Here are the six reasons why you might have an Opening Balance Equity on your balance sheet.

What does negative opening balance mean?

You can quickly fix some of them, while others require more effort investment, as you need to first investigate their nature. But at the end of the day, you need to zero the opening balance equity account. So, let’s hop right on to find out what the opening balance equity account is and why it can confuse you. The significance of Opening Balance Equity extends beyond mere numbers on a ledger; it ensures continuity and accuracy in financial reporting. By effectively managing this element, companies can maintain the integrity of their financial data, which is crucial for informed decision-making and maintaining stakeholder trust. Make your balance sheet look more professional and clean by clearing the balance in this account and bringing it to zero.

Opening Balance Equity in QuickBooks

This figure is essential for businesses transitioning to new accounting software or starting fresh financial statements. Opening balance equity is the offsetting entry used when entering account balances into the Quickbooks accounting software. This account appears in your organization’s chart of accounts as an equity account, and is created automatically by the software.